We help identify your goals and transform challenges into opportunities.

Starting the conversation

During our initial meeting, we take the time to get to know you and your family. We'll explore your goals and discuss any wealth management concerns you may have. We will introduce our wealth planning strategies and then, together, decide if it makes sense for us to work together.

Learning about your situation

Through a series of conversations we uncover the details of your financial situation. We discuss your long-term and short-term goals and priorities, the roles of your accountant, lawyer, and estate planning attorney and what wealth planning strategies you have in place. This in-depth discovery allows us to understand your total wealth management needs.

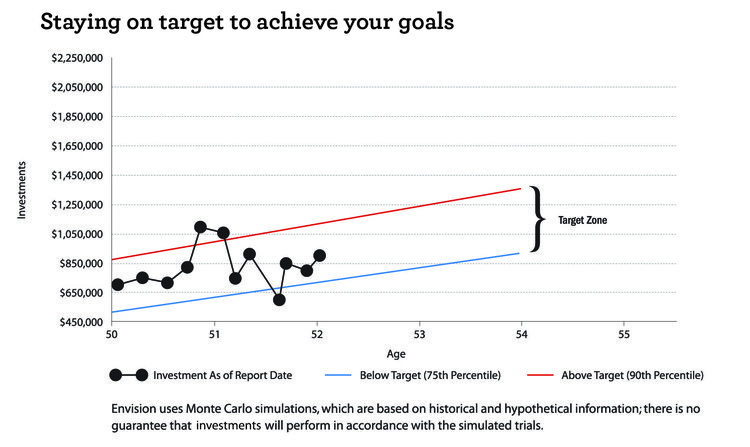

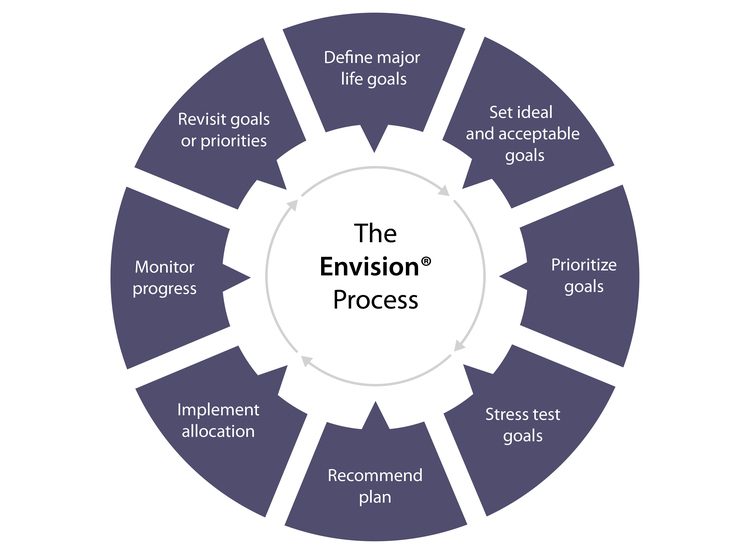

Creating your customized plan

Next, we employ our sophisticated Envision® planning software to help create your strategic asset allocation and investment strategy. We'll also create coordinated wealth management strategies to take into account your life and retirement goals, assets, liabilities, cash-flow requirements, levels of acceptable investment risk and asset allocation strategies.Because your wealth management plan may cover many different areas and multiple generations of family members, we may also coordinate with your other professional advisors.